Table of Content

Although most of these programs are available to repeat homeowners, like state programs, they can be especially helpful to people who are buying a first home or who haven’t owned a home in several years. With over 20 museums in Phoenix alone and more native rattlesnakes than any other state (13, if you’re curious), Arizona attracts everyone from outdoor enthusiasts to urbanites. The 48th state is a popular location for homebuyers, and with homeownership assistance programs, buying a home here is becoming a reality for even more people. To make the loan even more helpful, you don’t need to repay the second mortgage for at least three years, or until you sell or refinance the home. It’s forgiven monthly at a rate of 1/36 over the life of the loan. Perhaps best of all, Home Plus mortgages awarded through Fannie Mae and Freddie Mac come with lowered mortgage insurance premiums.

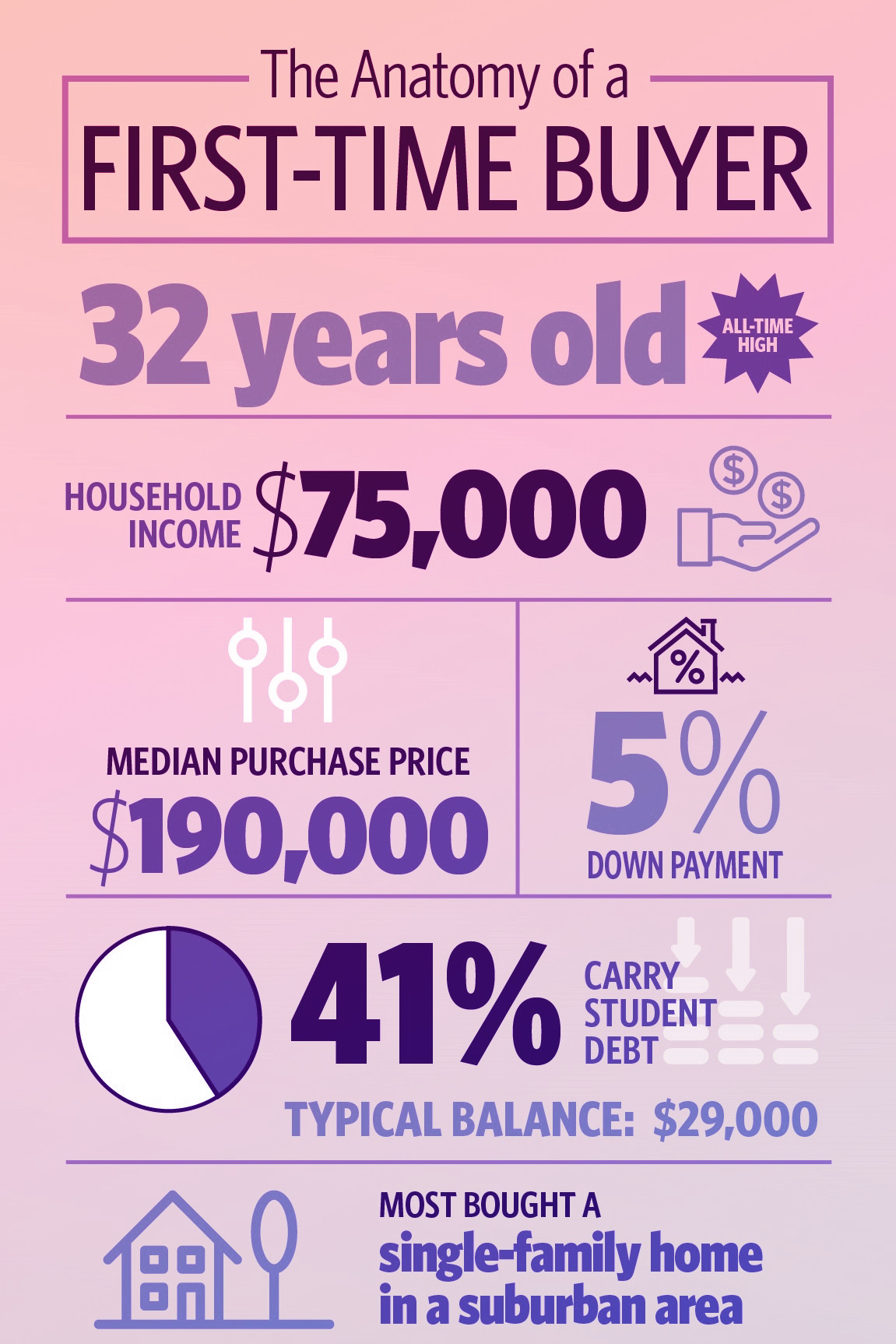

A home creates an asset that provides the ability to create wealth, borrow, and achieve self-reliance. Plus, renters may actually realize monthly savings on buying vs. renting. Yet with rents rising faster than wages, and high levels of student loan debt, it can be VERY difficult for first-time or boomerang homebuyers to save enough money for a down payment. Make your dream of being a homeowner come true with SoFi’s competitive mortgage rates and down payments as low as 3% for qualifying first-time homebuyers. The Home Possible mortgage is for buyers who have a credit score of at least 660.

Home in Five Advantage Program

Check with your lender, real estate agent, local nonprofit housing advocacy groups, and state housing finance agency for programs in your area. If your employer allows borrowing from the 401 plan that it sponsors, you may consider taking a loan against the 401 account to help finance your home purchase. With most plans, you can borrow up to 50% of your 401 balance, up to $50,000, without incurring taxes or penalties. You pay interest on the loan, which is paid into your 401 account. You usually have to pay back the loan within five years, but if you’re using the money to buy a house, you may have up to 15 years to repay.

This site is not affiliated with any news source or government organization and is not a government agency. This site is not affiliated with HUD, FHA, VA, FNMA or GNMA. Contents of this website are copyrighted property of the owner of this website.

Texas Mortgage Credit Certificate Program

If you’re missing a down payment or don’t want to wipe out your savings, these programs are designed for you to buy a home. These programs are administered through companies like us, to assist you in buying a home. Grants are funded by local government agencies or non-profits. Use the “Find The Best Program For You” to find the program and someone that administers that local program for you.

Applicants generally need a credit score of at least 620; pricing may be better for credit scores of 680 and above. Like the Freddie Mac program, HomeReady loans allow flexibility for down payment financing, such as gifts and grants. Applicants must be first-time homebuyers (you can’t have owned a home within the past three years) unless you’re a qualified military veteran or buying in a designated area. The nonprofit Community Investment Corporation administers the MCC program; income and purchase price limitations may vary by county. Has an excellent beginning guide to homeownership and tracks indicators and trends for the housing mortgage finance industry. Anyone looking to settle down in Maricopa County — which includes Phoenix and the surrounding area — should definitely consider assistance from the Home in Five program.

VA Loans

Apply early, it’s a no-cost pre-approval program, there are usually a large number of applicants. Even though some have gone away DPA advantage program is still available. National Association of RealtorsThis site features a national database and relocation search engine that searches for realtors, lenders, neighborhood characteristics, schools, etc. To qualify for a Good Neighbor Next Door discount, the home must be located in a “Revitalization Area.” Applicants must also agree to live in the home for at least three years.

No down payment is required on these loans to moderate-income borrowers that are guaranteed by the USDA in specified rural areas. Borrowers will pay an upfront guarantee fee and an annual fee that serves as mortgage insurance. Several federal government programs are designed for people who have low credit scores or limited cash for a down payment.

Down Payment Assistance Programs

A first-time homebuyer is defined as an individual and his or her spouse who have not owned a home during the three-year period prior to the purchase of a home. ADDI funds may be used to purchase one- to four- family housing, condominium unit, cooperative unit, or manufactured housing. Additionally, individuals who qualify for ADDI assistance must have incomes not exceeding 80% of area median income. With no loan limits, no down payment requirement and no mortgage insurance required, VA loans offer the most flexibility of any government-backed loan program. VA loans don’t normally require a down payment, but you can use down payment assistance to pay VA closing costs.

In addition, most programs let you use gifted money or down payment assistance to cover your down payment and closing costs. Depending on the mortgage loan you choose, you could potentially get into your new house with minimal cash out of pocket. Maricopa County offers eligible applicants the Home in Five Advantage program. This program helps low- and moderate-income individuals and families buy a home with down payment and closing cost assistance. Most first-time homebuyer programs include down payment assistance you’ll receive as a forgivable second mortgage or a grant.

In most situations, you need a FICO® credit score of at least 620 to secure a VA loan. You also need to pay a VA fund fee, which ranges anywhere from 1.25% to 2.4% of your home’s value depending on the size of your down payment . When you’re ready to start the home buying process, make sure you get personalized rate quotes from at least three mortgage lenders. But do an internet search " down payment assistance” to make sure you don’t miss any.

But if they sell the home before the full three years is up, they will be required to repay a portion of the assistance they received. Buy a house in Arizona using the best down payment assistance programs available. Arizona’s statewide Home Plus Home Buyer Down Payment Assistance Program exists to make homeownership a reality. From Flagstaff down to Tucson and everywhere in between, income- and credit-eligible applicants can be approved for a 30-year fixed-rate mortgage and down payment assistance up to 5 percent. For more information and to apply, visit the Home Plus official website.

While we cannot provide market commentary, it is widely recognized that the fixed income markets have been in a free-fall since the beginning of this year. The combination of record high inflation, the Feds reaction to that, combined with the war in Ukraine, has caused investors to reduce their participation in the mortgage-backed securities market. This has negatively impacted our ability to provide availability for our AzIDA HOME Plus down payment assistance offerings. This situation is not unique to the AzIDA’s HOME Plus program, as other DPA program providers are experiencing similar difficulties.

To provide you with a personalized experience and deliver advertising specific to you, SoFi may share some of your personal information with our 3rd party partners. If you do not allow this by either your browser settings or if you select "No (Opt-Out)" in the toggle below, you will experience less targeted advertising from our partners. As a SoFi member, you get access to exclusive benefits designed to help set you up for success with your money, community, and career.

No comments:

Post a Comment